OTT/VOD in Sri Lanka is growing rapidly, with more businesses and consumers moving online every year. While setting up an online store may seem straightforward, one of the biggest challenges merchants face is accepting payments securely and efficiently. This is where a payment gateway becomes critical.

Local payment gateways are particularly advantageous for businesses in Sri Lanka. They provide faster settlements, support local currencies, and offer better customer service than international alternatives.

PayHere has emerged as Sri Lanka’s top online payment gateway, trusted by small and medium businesses (SMBs), SaaS providers, subscription services, NGOs, and service-based companies. With features like recurring billing, plugin integrations, fraud protection, and robust analytics, PayHere ensures your business can process payments seamlessly.

In this guide, we will walk you through:

- PayHere pricing and fees

- Step-by-step integration for different platforms

- Security and compliance best practices

- Checkout optimization strategies

- A comparison with other Sri Lankan payment gateways

By the end of this guide, you’ll have the insights you need to choose the right payment gateway, optimize checkout for higher conversions, and manage your transactions confidently.

What Is PayHere and How It Works

A payment gateway acts as the bridge between your customer, your website, and the bank. It ensures secure authorization, payment processing, and settlement of funds.

PayHere fits seamlessly into this flow:

Customer → Checkout → Authorization → Settlement → Merchant Account

Key benefits of using PayHere include:

- Local currency support: Accept LKR and international currencies effortlessly

- Recurring billing: Ideal for subscription services or memberships

- Plugin integrations: Works with WooCommerce, Shopify, WordPress, and custom platforms

- Security: PCI-DSS compliant, tokenization, HTTPS

- Analytics & notifications: Track payments, refunds, and transaction success rates

Real-World Scenario

Imagine a local SaaS company offering monthly software subscriptions. Without PayHere, the company might struggle with cross-border payments or currency conversion issues. PayHere’s recurring billing support and local payment rails make it easy for customers to pay in LKR, while the business receives timely settlements.

Who Should Use PayHere

PayHere caters to a wide variety of businesses. Some examples:

| Use Case | Required Features | How PayHere Fits |

| SMB Ecommerce | One-time payments, refunds, analytics | Hosted checkout, partial refunds, transaction tracking |

| Subscription Services | Recurring payments, cancellations | Subscription billing & webhooks |

| SaaS Platforms | API integration, invoicing, analytics | Custom API, real-time notifications |

| NGOs | Donations, receipts, refunds | Easy checkout, recurring donations |

| Service Providers | Invoicing, flexible checkout | Hosted or embedded checkout, multi-currency support |

By offering both hosted and on-site checkout options, PayHere ensures a smooth customer experience while giving merchants flexibility in integration.

PayHere Key Features

1. Hosted Checkout vs On-Site Checkout

PayHere offers flexible checkout options to suit different business needs:

- Hosted Checkout: Redirects customers to a secure PayHere page for payment processing. Best for merchants who want minimal PCI compliance burden.

- On-Site Checkout: Customers complete payments directly on your website. Ideal for businesses wanting a fully branded checkout experience.

2. One-Time & Recurring Payments

- One-Time Payments: Process standard purchases or donations quickly.

- Recurring Payments: Perfect for subscription services, memberships, or recurring donations. Automates billing and reduces administrative work.

3. Refunds & Partial Refunds

- Process full or partial refunds directly from the dashboard or via API.

- Policies for partial refunds depend on merchant preferences, giving you flexibility in handling customer returns or adjustments.

4. Settlement Schedule Overview

- PayHere settles funds according to bank-dependent schedules.

- Merchants can track payout frequency, minimum thresholds, and ensure smooth cash flow management.

5. Basic Analytics & Reporting

- Monitor key payment metrics like transaction success rates, declines, and refunds.

- Webhooks allow real-time notifications to your systems, enabling better financial tracking and operational insights.

6. Security & Compliance Features

- PCI-DSS Compliance: Protects cardholder data and shares responsibility between gateway and merchant.

- Tokenization & HTTPS: Ensures sensitive card data never touches your servers.

- Fraud Reduction: Includes AVS/CVV checks, velocity rules, and optional 3DS authentication for secure transactions.

7. Plugin & Integration Support

- Ready-to-use plugins for WooCommerce, Shopify, and WordPress.

- Developers can use APIs for custom integrations, offering flexibility for complex business models.

8. Mobile-Friendly Checkout

- PayHere’s checkout is optimized for mobile devices, ensuring smooth transactions on smartphones and tablets.

- Supports express pay options for faster conversions and a better customer experience.

9. Multi-Currency Support

- Accept payments in local LKR and international currencies.

- Facilitates cross-border payments for Sri Lankan merchants selling globally.

PayHere Pricing & Fees

Understanding pricing helps merchants plan cash flow and optimize costs. PayHere’s fees typically include:

- Merchant Discount Rate (MDR): % of transaction amount

- Fixed fee per transaction

- International card premium

- Chargeback fees (if any)

Settlement timing is bank-dependent, and minimum payout thresholds may apply.

Sample Cost Scenarios

| Scenario | Estimated Fees | Net Settlement |

| Domestic one-time purchase | LKR 20 + 2% MDR | LKR 980 |

| International card purchase | LKR 50 + 3% MDR | LKR 950 |

| Monthly subscription | LKR 15 + 2% MDR | LKR 985 |

⚠️ Always confirm fees on PayHere’s official website before finalizing pricing.

Optimizing Checkout for Higher Conversions

UX Best Practices:

- Fewer form fields → reduce friction

- Guest checkout → faster purchases

- Mobile-first design → majority of users shop via mobile

- Express pay options → faster checkout

Reducing Payment Failures:

- Retry options, alternative payment methods

- Clear support channels and refund instructions

PayHere vs Alternatives

PayHere is ideal for local acceptance, domestic settlements, and subscription-based merchants.

Other gateways in Sri Lanka:

- WebXpay

- DirectPay

- OnePay

| Gateway | Features | Setup Speed | Fees | Best For |

| PayHere | Local payments, recurring billing, plugins | Fast | Varies | SMBs, SaaS, NGOs |

| WebXpay | Domestic & cross-border | Medium | Varies | Export businesses |

| DirectPay | Simple payments | Fast | Low | Small merchants |

| OnePay | International focus | Medium | High | Export-focused merchants |

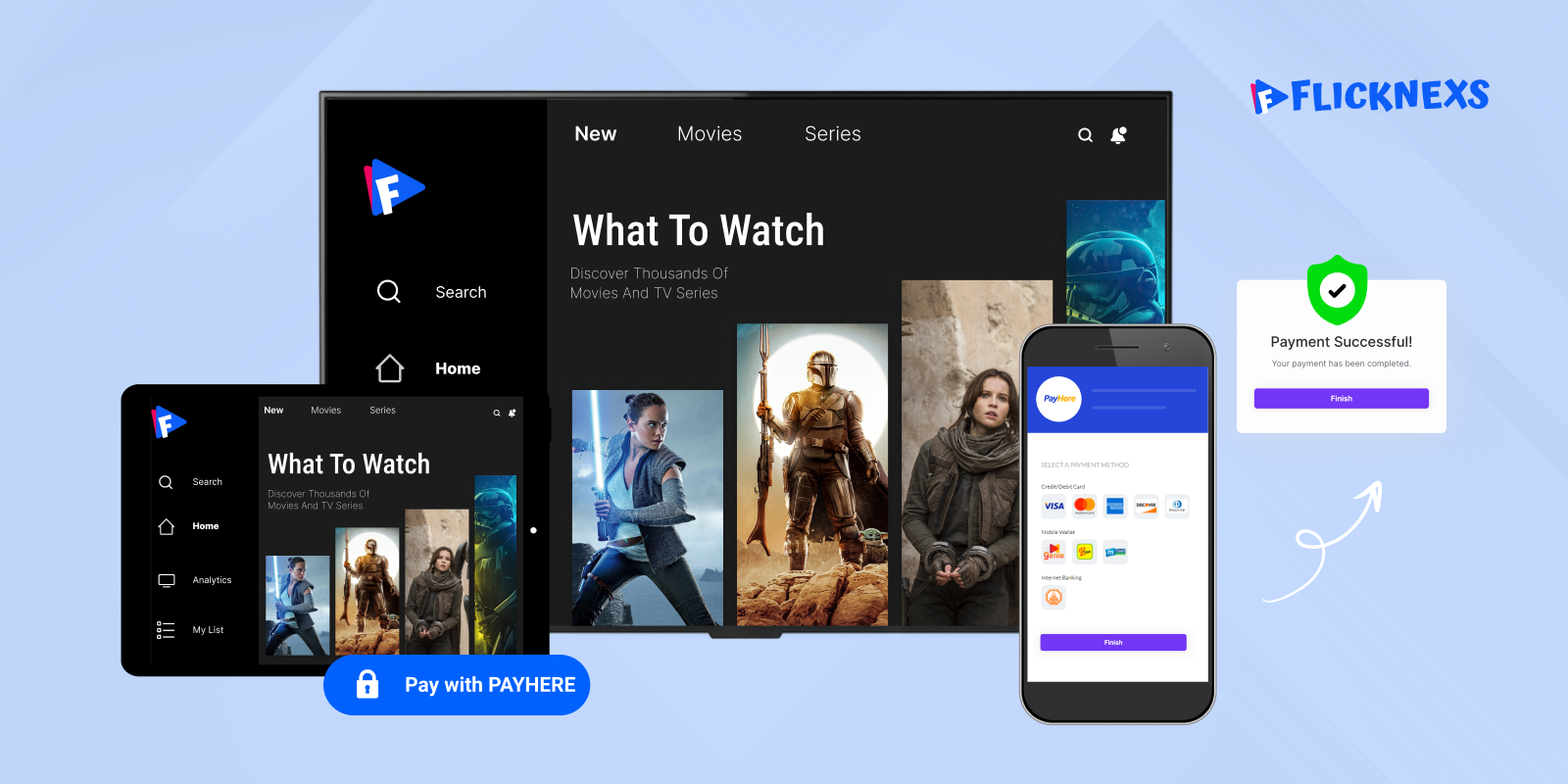

Expanding Your Digital Business with Flicknexs

For Sri Lankan businesses exploring digital content, OTT platforms, or subscription-based services, Flicknexs offers a powerful solution to monetize video content seamlessly. By integrating Flicknexs with your payment gateway setup, you can:

- Accept one-time and recurring payments for digital content.

- Launch white-label OTT apps without complex development.

- Track subscriber behavior, revenue metrics, and churn using advanced analytics.

- Offer a mobile-first, in-app payment experience for smoother conversions.

By combining PayHere for local ecommerce transactions and Flicknexs for OTT or digital subscriptions, businesses can streamline payments while expanding into new revenue streams.

Conclusion

PayHere empowers Sri Lankan businesses to accept payments seamlessly, with features like recurring billing, plugin integrations, and robust security.

Before going live:

- Confirm pricing and fees on the official site

- Run sandbox tests for all scenarios

- Use the integration checklist to ensure smooth setup

Actionable Tip: Compare PayHere with 2–3 other gateways to make a confident choice for your business.

Leave a Reply